Votre quotidien d’inspiration et d’innovation

Actualités

Retraite

Philippe Candeloro, 51 ans : balance le montant incroyable de sa retraite

Philippe Candeloro se confie sur sa retraite prévue À l’âge de 51 ans, il aborde sans détour les défis qu’il anticipe avec une franchise qui lui est propre. Sur le plateau de l’émission « Chez Jordan …

Santé

Stéphane Plaza souffrant : il dévoile des récents défis de santé hyper douloureux

Retour sur l’année 2022… Une année mouvementée pour Stéphane Plaza Malgré une carrière florissante et une popularité croissante, Plaza a rencontré des défis personnels et professionnels, notamment en matière de …

Social

Mère de 10 enfants : les allocations peuvent influencer les décisions de vie… elle profite

Les allocations familiales : une aide ou une incitation ? Ses choix de vie ont …

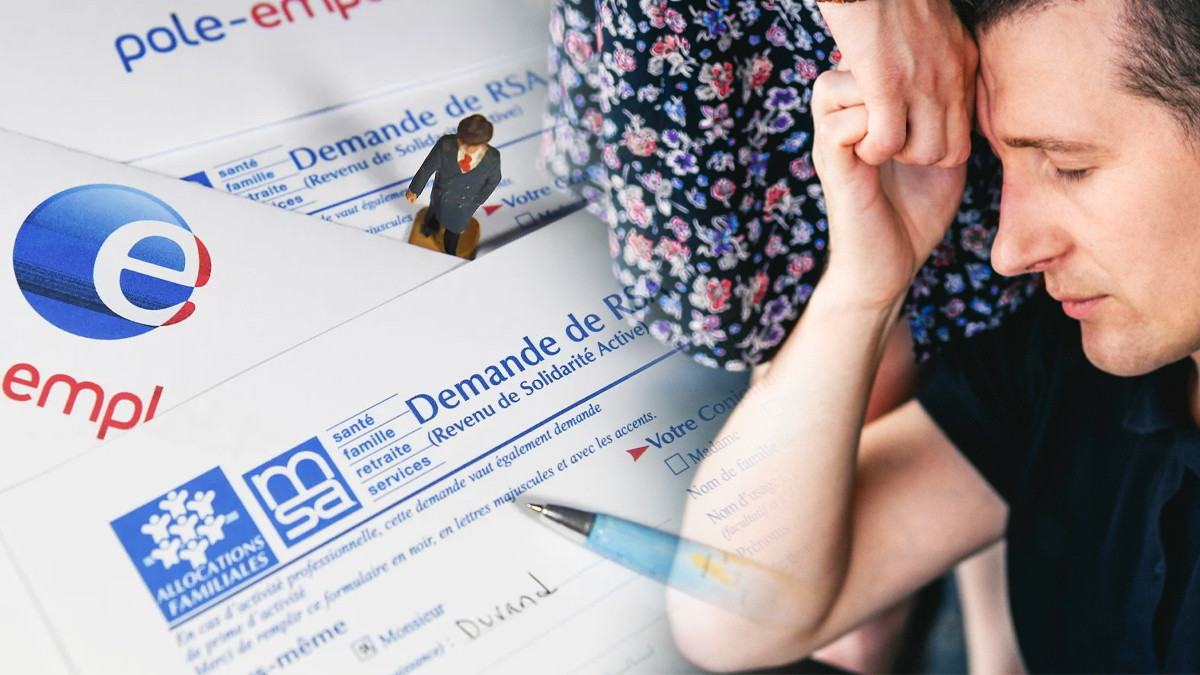

Un couple au RSA avec plus de 500 000 euros en banque a tout perdu en étant rattrapé par la justice

La découverte choquante des comptes bancaires Cette situation a soulevé de nombreuses questions, car ils …

CAF : ce couple qui bénéficiait du RSA s’est fait prendre avec plus de 300 000 euros d’argent

Une fraude au RSA dévoilée Ce cas soulève des questions sur la surveillance et l’éligibilité …

Votre rêve d’acquérir une maison : combien vous devriez gagner, le salaire minimum qu’il faut toucher

Le défi d’acheter une maison en france en 2024 Avec des prix en constante augmentation, …

Le nouveau Pass Colo de 350 euros est une aubaine pour vos projets de vacances en famille

Une opportunité pour les vacances des enfants Les colonies de vacances sont une option attrayante …

Une mère de 13 enfants utilisant 50 000 euros d’allocations familiales suscite débats

Un soutien financier qui fait débat Ces aides, destinées à soutenir les familles, varient selon …

Astro

Prévisions astrales pour le Lion la semaine prochaine : amour, argent, santé (Prévisions du 22 au 28 avril 2024)

Prévisions du 22 au 28 avril 2024 pour le Lion Voici un aperçu de vos …

Le Scorpion est considéré comme le signe astrologique le plus rancunier

Le Scorpion: plus qu’un simple signe astrologique Les Scorpions, par exemple, sont connus pour leur …

Le signe astrologique le plus enclin au désordre à la maison et celui qui adore imposer l’ordre

Un aperçu rapide sur l’influence astrologique sur le comportement à la maison Peut-être que vous …

Ces signes du zodiaque vont vivre un amour intense ce printemps

Un mardi d’avril 2024 marqué par le destin pour certains signes astrologiques Pour certains signes …

Horoscope chinois du vendredi 19 avril 2024, trouvez votre animal spirituel

Introduction à l’astrologie chinoise Chaque signe du zodiaque chinois, représenté par un animal, a des …

Comment les étoiles façonnent votre manière d’aimer et de connecter avec les autres ?

La danse des signes du zodiaque dans l’amour Que vous soyez Bélier ou Poissons, chaque …